前面连续3篇文章对比分析了主流市场的因子表现,

在推进到因子组建策略的过程中,遇到一个问题,很多大类因子还有子因子,

有的是现成的一个指标,有的是多个指标混合而形成一个因子,

因此,在推进因子投资策略落地之前,首先我们要搞清楚主流因子的构建规则。

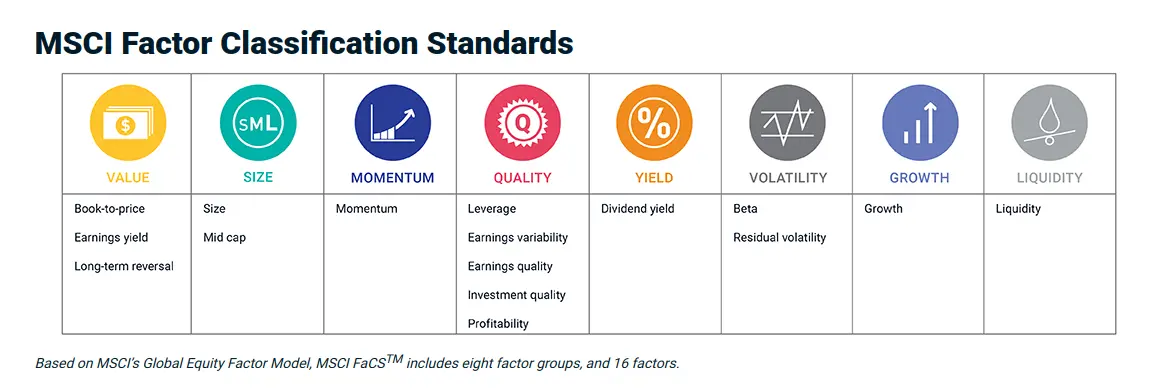

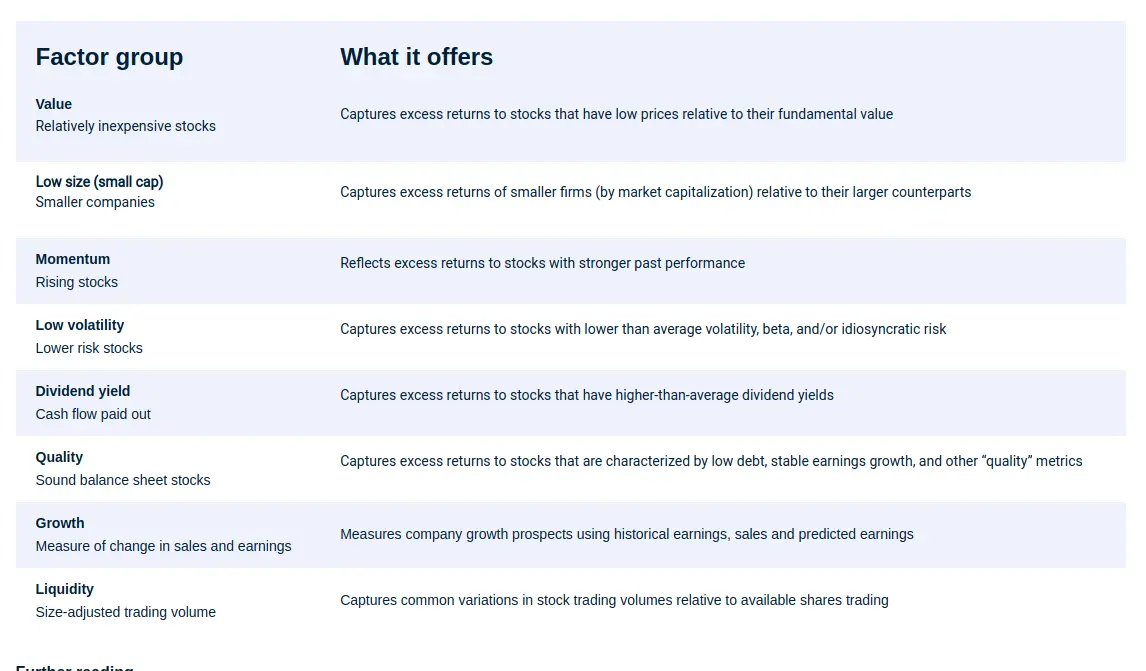

还是从我们的老朋友MSCI这里来学习,首先是它的分类标准,8个因子组,16个因子

每一类因子的作用,

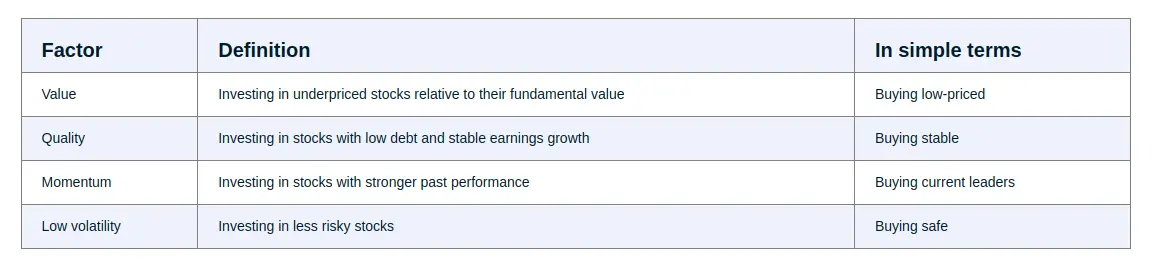

如果觉得理解有难度,MSCI还细心的给了一个tip来解释,

比如价值,就是买价格低于基本面价值(内在价值)的,简而言之就是买低定价的(不等于低价)。

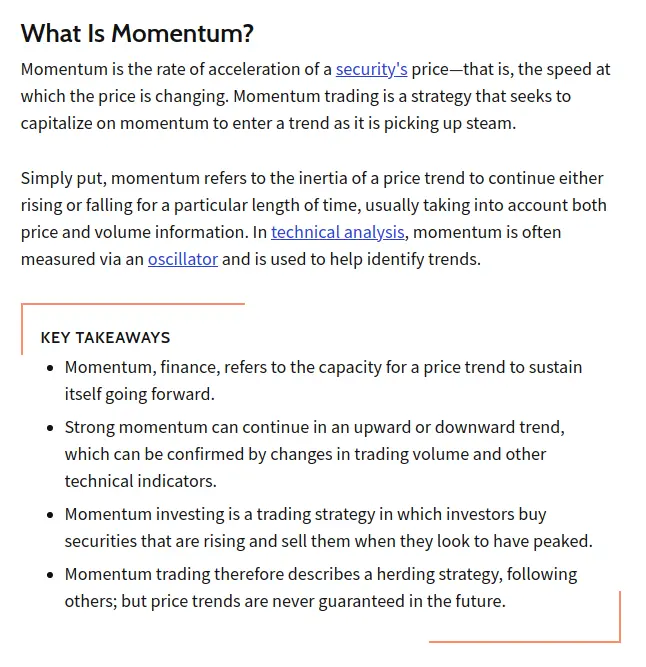

其他因子都还好,稍微麻烦的动量momentum,按传统定义,

动量描述的是加速度,在金融领域,则侧重价格趋势持续向前的能力。

动量投资,是一种跟随领头羊的思路,谁跑得快,我跟谁跑。

与之对应的缺点是,领头的转向跑路了,跟随的人可能会踩踏。

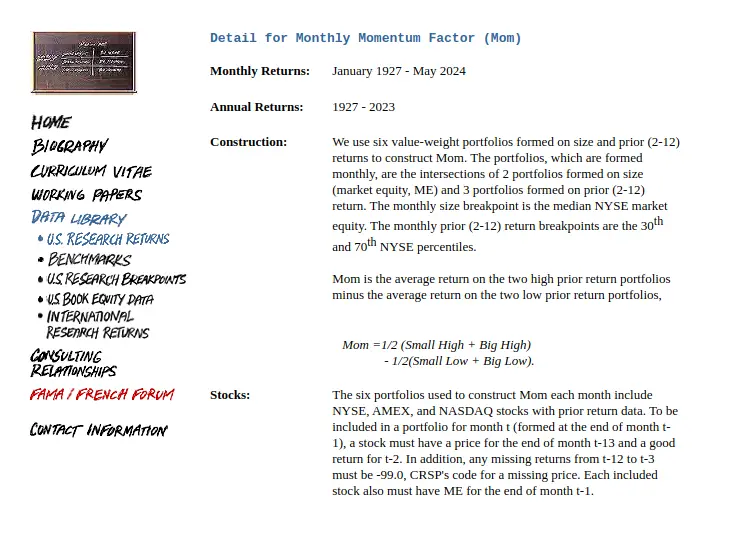

学术界,关于动量的经典定义,

具体到股票层面,引用一段解释:

Nowadays, momentum strategies are well-known and generally accepted in both the public and academic worlds. Yet, the momentum strategy is based on a simple idea, the theory about momentum states that stocks which have performed well in the past would continue to perform well. On the other hand, stocks which have performed poorly in the past would continue to perform badly. This results in a profitable but straightforward strategy of buying past winners and selling past losers. Moreover, the strategy selects stocks based on returns over the past J months. It holds them for K months, the selection of J and K is purely dependent on the choice of the investor, but we are presenting results of 12-1 month momentum strategy. To sum it up, the stocks which have outperformed peers during the K months period tends to perform well in the upcoming period and vice versa.

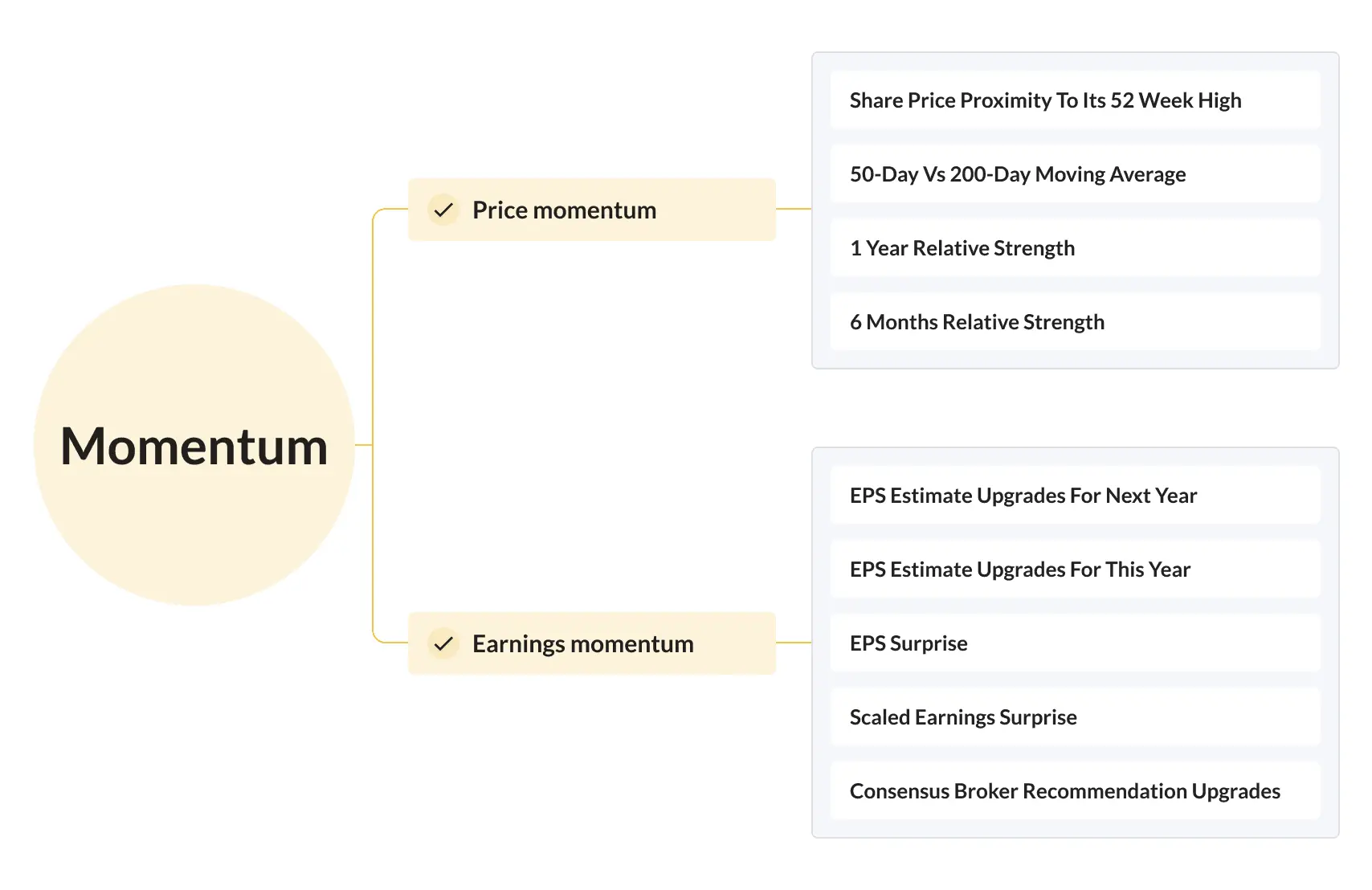

看图更直观:

动量可以划分为价格面、盈利面,可以用数十种指标来观察,当然现代还发展出一些组合复杂的动量指标,

不过经典的这集中,已经足够耐用有效。细分的动量指标如何应用,是我们接下来的实践方向。

更多关于因子投资的介绍可以看这里。